Connecting Across Communities and Cultures

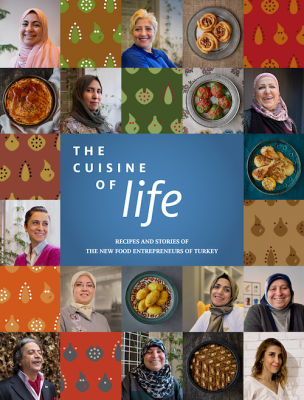

“The Cuisine of LIFE”

“The Cuisine of LIFE”

Since 2011, the Syrian Civil War has forced than 5.6 million people to flee the country, with 3.6 million in Turkey. In light of this massive influx of refugees, Turkey is in need of durable, innovative solutions that create jobs and create sustainable livelihoods while easing social tension. To address the global refugee crisis, CIPE and a Consortium of international partners developed the Livelihoods Innovation through Food Entrepreneurship (LIFE) Project. The LIFE Project supports and encourages entrepreneurship, job creation and cross-cultural engagement in the food sector in Turkey. The cookbook features more than 50 recipes from 25 individuals from the region: Turkey, Syria, Iraq, Yemen, Egypt, Algeria and others. The Cuisine of Life is a unique collection of wisdom, stories, and culinary treasures shared by some of the leading minds in the food industry internationally and rising stars of Turkey’s food scene. With short essays about the special role of food in building community and businesses, the book features recipes and stories from LIFE Project members who graduated from the LIFE Project Entrepreneur Incubation Program. To learn more about the LIFE Project, please visit: www.lifeforentrepreneurs.org.

Tamweely app

In 2017, with the support of the World Bank, CIPE developed an Arabic-language online platform and mobile application called TAMWEELY, Arabic for “My Financing”, to connect entrepreneurs with banking and non-banking sources of finance and guide them through the process of establishing a business. The app filters appropriate sources of finance based on each entrepreneur’s business profile, and includes reference material tailored to the Egyptian context, such as how to develop a business plan, corporate governance, and accounting and finance.

This app solves a common problem for micro, small, and medium enterprises (MSMEs)—that they cannot access financing to start or grow their businesses. The reasons for this are varied: the regulatory framework for MSMEs is often unclear, which makes banks reluctant to loan money to MSMEs because they fear their investment will not be repaid; the general public has the perception that banks in Egypt only work with big business; entrepreneurs are not aware of the existing bank and non-bank financing opportunities or they do not know how to approach a finance institution for funding; and rural MSME owners may not be able to physically access the banks and firms that would provide opportunities. The app offers a practical, accessible solution to connect entrepreneurs with banking and non-banking sources of finance. To learn more about the TAMWEELY app, please visit: https://www.tamweely.org/.

Published Date: February 28, 2020