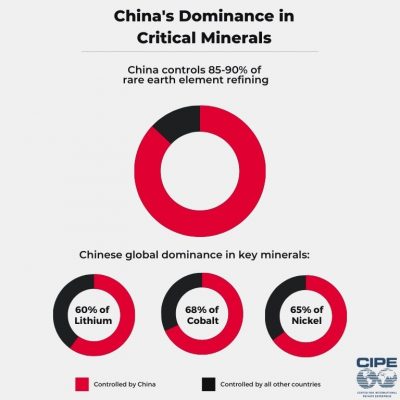

This concentration of power, dominant especially in mineral-rich nations like the Democratic Republic of the Congo (DRC) and Indonesia, carries significant implications. While Chinese investment has helped generate growth in these and other countries, Beijing’s practices, including massive overproduction and a disregard for international standards, create an uneven playing field. Chinese refineries flood the market with cheap minerals, undercutting competitors and driving prices to unsustainable lows.

This concentration of power, dominant especially in mineral-rich nations like the Democratic Republic of the Congo (DRC) and Indonesia, carries significant implications. While Chinese investment has helped generate growth in these and other countries, Beijing’s practices, including massive overproduction and a disregard for international standards, create an uneven playing field. Chinese refineries flood the market with cheap minerals, undercutting competitors and driving prices to unsustainable lows.

The consequences extend beyond market competition. Governments face reduced revenues due to depressed prices and, in some cases, are burdened with combatting outright fraudulent activities by Chinese firms. Local mining communities, including artisanal miners, receive a diminished share of the profits. Furthermore, lax environmental and labor standards raise serious ethical concerns and can fuel instability in already fragile regions.

Addressing Economic and Security Risks

China’s control presents economic and security risks for industries relying on these refined minerals, limiting supply chain diversification and increasing vulnerability. Consumers in democratic markets also increasingly demand responsibly sourced products, which the Chinese firms cannot guarantee.

Creating a competitive and ethical critical minerals market is essential for a secure and sustainable global economy. It demands collective action to ensure a level playing field where innovation, fair competition, and responsible practices can thrive.

The Center for International Private Enterprise (CIPE) is part of the global effort to combat such harmful economic and expansionist influences of authoritarian regimes by calling out corrosive capital investments and promoting constructive investments in accountable markets. Indeed, addressing the complex challenges around critical minerals requires a multi-faceted approach. Governments must insist on fairer agreements, establish robust oversight mechanisms, and promote transparency. The private sector must explore options for valuing sustainably produced minerals, while civil society plays a crucial role in monitoring practices and advocating for higher standards.

Creating a truly competitive and ethical critical minerals market is essential for a secure and sustainable global economy. It demands collective action to ensure a level playing field where innovation, fair competition, and responsible practices can thrive.

The DRC, for example, succeeded in renegotiating a minerals-for-infrastructure deal that will net the country an additional $4 billion in infrastructure funding on top of the original $3 billion that was promised but never delivered. The DRC government’s success shows that when governments insist on a fairer distribution of benefits, they can win.

CIPE’s BRI Monitor Tracks Chinese Investments

One of the ways CIPE is shedding light on China’s unfair and destructive practices is through the BRI Monitor. The BRI Monitor is a global transparency and accountability initiative that tracks China’s Belt and Road Initiative, uncovering the true terms and full costs to countries and communities. Partners include independent think tanks and civil society organizations supported by CIPE. This work identifies governance gaps that make countries vulnerable to corrosive capital situations, as well as ways to mitigate risk and position markets for constructive capital investments.

For more on this subject, download our policy brief, Examining Chinese Practices in the Critical Minerals Market.

CIPE is in the process of producing a “practitioner’s guide” on mitigating corrosive capital and attracting constructive investments. Please visit brimonitor.org to sign up for our newsletter and be alerted when it’s published.

Published Date: March 27, 2025